It’s hard to tax income if there’s no reported income

Unrealized gains tax. Lets fucking go.

Rewrite the laws that if it’s collateral, it’s realized.

Tax the loans based on collateral as income and you don’t even need to figure out the value of the collateral.

Here we go; this guy gets it.

Then everyone taking out a home equity loan suddenly has to pay the taxes as if they sold their house.

Ok so make it that equity in a primary residence is exempt.

I just get loans on untaxed offshore collateral and write it off as a business expense like everyone else, don’t you?

But that’s not what the sign on the side of the road says…skeptical.

But then what will trickle down???

I’m kinda thinking we maybe try trickle-up for a few years.

We are the workers and the consumers. We are the ones who trickle down.

I am the one who trickles.

We already have that. It’s called political donations.

Unfortunately, the urine based system where richer people pee wealth on less rich people who then pee on poorer people and so on isn’t sound economic theory. Call me surprised, and soaked in freedom pee.

The data is in. Trickle down doesn’t work.

(I was being facetious)

Nothing trickles down, we have seen that for decades.

(I was being facetious)

That’s reasonable

Poor people: “Unacceptable!”

But one day I might be in the 1%! And when I am, I’ll show people like ME a thing or two.

Problem is a solid 30% of those that vote see themselves potentially attaining that

99%1%, as baffling as that is.Edit

You mean 1%?

I do, yikes, thank you

Strangely enough, most people will be in the top 5% at some point in their life. But just for a year, when they sell their house. So you’re getting fucked 75 years of your life for maybe 1 year of benefit?

More like you busted your ass for 75 years then got fucked when you had to sell your house.

I am not from the US so might be wrong, but I think it works the same as in mine. It is because they tax income not wealth (which would be difficult I guess). Elon can probably live on $0 income very comfortably by his standard. More than 1% of income earners will be affected at some point as you age up, inheritance etc. Maybe not 30%

Well hell, sign me up!

Common Dreams - News Source Context (Click to view Full Report)

Information for Common Dreams:

MBFC: Left - Credibility: High - Factual Reporting: High - United States of America

Wikipedia about this sourceSearch topics on Ground.News

“Hey, I’m in the bottom 99%, I like this promise”

You know who else is in the bottom 99%, your fucking landlord. if you pay 1% less tax you can buy a whole bag of doritos if they pay 1% less tax they can buy your Mum’s house.

Government only needs to pay lawyers to go after what the 1% already owe and it would be more than any increase would provide.

You’re being a bit obtuse and misleading here, clearly you didn’t read the article.

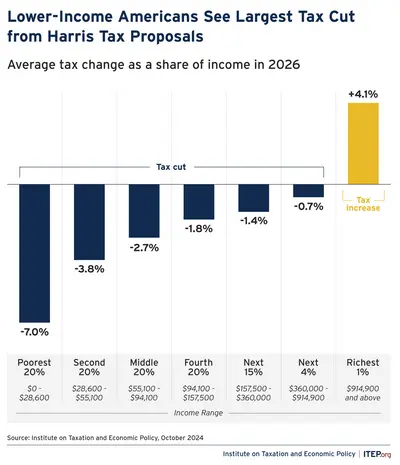

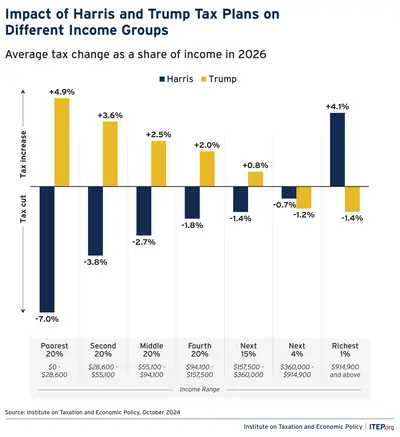

For starters… its not an income level agnostic tax decrease. Its not a flat tax.

Its graduated. Progressive. And it decreases taxes for all but the wealthiest, whose taxes increase.

The group estimated that under Harris’ proposals, the poorest 20% of Americans would see an average tax cut of $1,130 in 2026 while the richest 1% would see an average increase of $121,460.

Sad as it is, our political system offers a binary choice.

Would you perhaps prefer the alternative?

EDIT:

If Harris wins, we can also reasonably expect a continuation of the Biden policy of doing that other thing you want, the IRS actually going after people in the ‘landlord’ brackets for tax evasion.

Has that been as extensive as you or I would prefer?

No.

But the alternative is Trump, who, along with Elon, might just abolish the IRS, or massively defund those efforts.

Is that the difference per bracket, or the net difference per income level? Because I think it’s the latter but I’m not sure

The images I used are, I think, shitty thumbnail versions of whats actually on the article as I only have a shit tier 4g phone.

If you go to the article’s page itself, you can make out the bracket definitions better.

That being said: (Threw this all in a spoiler so as to not further wall of text this thread)

These x axis are grouped into income tax brackets.

The US Federal income tax has long been broken up into a sort of stair step, series of brackets.

Declare x amount of yearly income, you fall into bracket 1, earn more next year? y amount of income? You may move up to bracket 2.

The brackets precise income level boundaries of the brackets, are updated each year based off of I think CPI (inflation) according to a known and established law and formulation.

This graph indicates the change in the amount of taxes you pay in percentage terms of your precise income.

I’ll attempt to explain in detail.

The way to read this… say you’re at the very first income bracket, 0 to $28k ish, and that for the sake of example, you make exactly 28k a year.

Right now, you pay… whatever % and amount of taxes as is currently the norm.

Under Kamala’s plan, you’ll pay 7% of your 28k, or $1960 less in taxes than in the current schema.

Under Trump’s plan, you’ll pay 4.9% of your 28k, or $1120 more in taxes.

If we go to the other side of the graph… lets say your income is exactly $1 million bucks.

Kamala plan: You pay $41k more in taxes.

Trump plan: You pay $14k less in taxes.