They’re not even subtle about it. The system directly rewards you for being in enough debt to always be paying someone interest but not enough that you might file for bankruptcy.

You don’t have to be in debt, but you do need open credit lines. Having debt on them actually makes your score worse.

Her score likely went down because she closed out a credit line, i.e the open loan, so technically the “i have an open 5yr loan ive been paying on diligently” is no longer part of her score. The fact that she did pay it off is part of that score, but its weighted differently.

If she instead had 40k of credit cards she had open for 5yrs, with zero debt on them, her score would have gone up. Just having the account open, even not using them, shows a high “credit to debt usage” ratio and “a long time open loan.” Both of those make up about 45% of your “credit score.”

So no, you dont have to use a CC every month to keep a high credit score. If you want a high score, you want to open a credit card or 2 for their max value until you get about 30k-40k of total credit, and then don’t use them at all. Not a bit. Never close them. The “long time accounts” + “high amount of debt not in use” + “never delinquent” is roughly 80% of your score. You can sail into the 700s/800s if you dont have any other credit hit.

While this is all technically correct it’s still dogshit that your score goes down when you do the thing you are supposed to do with a loan.

Your options are:

Take out a loan and pay it off: score goes down

Take out a loan and don’t pay it off/default: score goes down

Remember that your credit score doesn’t exist for you. It’s not for your benefit. It’s for the benefit of lenders, and they don’t give a damn how unfair the system is.

This is what people are missing. Credit score is a completely valid metric, but it’s just a measure of how likely lenders are to make money off of you.

What I don’t get is: since she paid off her car loan, she’d have more disposal income now…? Shouldn’t that increase her credit score?

There’s a mess of things that go into their formula, but as I recall one of them is actively paying on things. We had our daughter get a credit card and told her that, instead of using her ATM all the time, she should use the credit card, but pay it off every month. Doesn’t cost her anything to do that, and it builds a credit rating way more than having a card with a zero balance. Doing that, they’ll also end up raising your limit, which increases your rating too. Oh, and if you pay your credit bills as soon as they come due instead of just before the deadline, that also increases your rating.

Ah! I get it. So it’s a valid metric in theory. It’s shit for everyone in practice.

Seriously. “I rarely take on debt, regularly save aggressively, and pay off my debts as quickly as is convenient” means I’m bad to loan to in their eyes when if you had evidence of all that as an ordinary person I’m exactly who you’d want to loan money to.

That’s how I’ve tried to be (and currently have no debt!).

When I needed to buy a car a few years ago, they gave me a terrible rate because I had a bad score. I had paid off a couple of personal loans AND all my student loans…but it’d been a few years so my credit score had dropped. So fuck me for not borrowing money every day.

I ended up doing a co-sign for a better rate. And guess what? I paid off that car loan a couple years early and got dinged on my credit just like the original post.

But I know they don’t care about any of that and are actually mad I didn’t pay the minimum for the entirety of the loan.

If I would loan money to people, I want them to pay me back as soon as they can. But if I wanted to make money with loans, I’d want my customers to pay their loans as slowly as possible to put a lot of interest rates in my pocket.

Your second option is 2 options. You dont need to default, just never finish paying it off.

Maybe you could just keep refinancing over and over until you’re making 0.01 payments a month on 100 loans. And have a max credit score.

Real-life min/max’ing right here

The terms of a loan boil down to “we’ll give you x, pay it back plus interest in y amount of time”. How do you stretch something with a legally binding predetermined end out indefinitely without hurting your score or financial wellbeing?

Take out a personal loan for the balance?

Isn’t that just kind of burning money at that point, i.e. harming your financial wellbeing? Also, aren’t personal loans seen as “bad” for credit score purposes? I had to take one out a few years back and my score dropped like 45 points within the week

You do have to use them a little bit though. It wasn’t a great surprise to learn that my credit score evaporated right when I was looking to buy a house because a credit card I hadn’t used in 7 years was turned off due to not using it. Having no debt, lots of savings, and decent income apparently counts for nothing.

Having no debt,

This is the only part the credit reporting agency sees. In that situation they have to make the lending score base on your history, which tells them nothing of your current situation.

lots of savings, and decent income apparently counts for nothing.

The credit reporting agencies don’t see any of this. There is no component in a credit score for your savings or income.

Sure, the credit agency doesn’t see it, but the person I’m talking to at the bank to get a loan can see it when I show it to them. But it doesn’t matter and they only really seem to care about the credit score.

My guess is that the bank may start with the credit score, and if its below a threshold the bank is willing to lend to, then they don’t look any further. Unless you have a truly egregious credit history, you’ll likely find other lenders more interested in your business.

Most companies don’t want every customer. There are those that only want the safest customers because they have the lowest risk, and that may mean you might get declined even if you would otherwise have the means to service the debt.

I don’t know why this dude is getting downvoted. This is basically what I do. And I have a great score.

Yeah I dug into all this a while back while I was trying to raise my score. Turns out the most productive thing I did was just ask my current cards to up my limit. A couple of them doubled, so it dropped my utilization way down, which shot my score way up. I think I was around 675 and went up to 750 just with that trick. I got into the 800s by paying off the credit cards.

Its an annoying metagame you have to play to get the “good interest rates,” but those little tricks can save you a fuckton of money over time.

I think the point here though isn’t as much ‘how do we play the game?’ as it is why there hell are we all forced into playing a metagame that is so inherently harmful and specifically designed to encourage risky behavior (I.e. the idea of debt being favorable)?

It’s a measure lenders use to figure out how likely they are to make money from loaning to you. It’s a very successful metric for them. It’s not really for your best interest, but if you’re aware of what goes into it there are simple, harmless things you can do to raise your score and help you get better rates.

why there hell are we all forced into playing a metagame

Because the alternative is “how white are you”

Yep, find credit cards with no monthly fee and open them. I have 3 lines of credit and only use the one with the highest benefits. I pay off the bill after it hits my statement, and my credit is always 780-790. Also, like you said, up your limit if you can to get a lower debt to available credit ratio.

Edit: I bet the people down voting me have terrible credit lol.

Try paying it off before it hits the bill. I bet you can squeeze a few points out of it. A friend and I both do that and I’ve been at 804 since summer and his sits between 810 and 815. Although in truth there’s no real difference between your lowest and my friend’s highest in terms of what interest rates you’ll get.

Every time I’ve done that it seems to tank my score by like 10 points. No idea what that’s about, the whole system is so convoluted its hard to tell what really makes it go down when it does sometimes.

It’s fucking weird for sure. If it works for you, do it.

I think the only way we will know this is real is if you post your social security number too. You know, for science.

So I should get five more credit cards and not use them?

I feel like you meant this sarcastically, but the answer is probably yes.

The trick is to not use them though, which so many seem to struggle with. If you’re someone who struggles to manage debt, then getting more credit cards WILL BE DISASTEROUS.

So, sounds like a skill issue /s

You can use the cards, just don’t carry a balance. If you don’t use a card ever, it’s likely going to get cancelled.

The easy thing you can do is set recurring bills only to a credit card and then set that card to auto pay the entire balance each month. Something like Netflix or even your electricity bill.

Put the bill on the card, and if you don’t have the willpower to shove the card in the back of a drawer and never use it, cut it up. The card doesn’t go inactive, you don’t rack up debt or interest, and you can maintain a high credit to debt ratio.

Yep. This was a big part of my strategy when I rebuilt my credit. I have a pile of cards, several of which have a single bill associated with them. I wanted to cancel because now I have a great score and a couple of really high limit cards, but that drops my length of history.

So I’ll be sitting on these low end cards forever probably. They’ll pay a single bill, get paid off before it closes for the month (that’s the number that gets reported to the bureaus) and every month from now until I decide I never need credit they’ll report $0. Just like they have the last 5ish years.

Don’t want to set here and repeat TexasDrunk, but yeah, that’s largely what i do.

Though my solution for most cards is to buy a candy bar with each card towards the end of June every year (I have a handful of niblings who were all born end of June through July, so makes a good little treat for when I come to visit)

deleted by creator

I’m not American, but a credit card means that you owe a bank money, right? If I owe my friend money I’m in debt with him. How is having a credit card not being in debt?

Just having a credit card doesn’t mean you’re in debt. Its a line of credit. You can choose to use it and carry debt, but there’s no requirement you do so. The long term consequence is that a bank may choose to close your credit card account if you don’t use it for a long time. The shortest time I’ve had a bank threaten to close an unused card of mine was 5 years. Even then, you can by a $5 sandwich on the card, pay it off immediately, and reset that timer of non-use for another 5 years in that case. I have other cards I haven’t used for 15 years and the accounts are still active.

deleted by creator

O wow, strange system. So you are basically encouraged to sign up for a service that you won’t use?

Its a bit of gaming the system, but I see the logic in it.

Since self control is an important part of repaying debts, having a card (line of credit) that you could use, but don’t, indicates you have a level of self control. There are people that, given any amount of credit line, will immediately run the debt up to the limit.

The measure of a person having a line of credit and not using it indicates to lenders you do have that level of self control. This isn’t the only input used in a lending decision, but I can see the value of it when we’re trying to determine one small test applied to general large populations.

The credit score is based on how much money the banks think they can make off of you, not your moral standing.

I should partner up with someone who does that while I do the consistent thing and we cover each other.

Wait.

That’s illegal.

Is it? Why?

Reasons.

The system directly rewards you for being in enough debt to always be paying someone interest but not enough that you might file for bankruptcy.

The only interest I pay is a mortgage, but my score is over 800. It must be rewarding for something else too.

Same, mostly. Use the credit card for the cash back and points. Pay the balance off every month. Only things I pay interest on is my mortgage and car.

It’s been a bit since I took personal finance, but I think it takes into account your assets too.

Sorry for the negative vote, but credit score does not take into account your assets. I just dont want folks to think that might be the case. Personal assets will come into play when a creditor considers you for a loan/line of credit/etc along side your actual credit score.

Edit: Well. This is turning into a wall of text.

Credit score is based on several things:

-

Ratio of debt available to debt used. I’m trying to remember where the sweet spot is, but it’s somewhere around 10% to 20%. If your credit cards have a cumulative limit of $20k, aim for a maximum use of $2-4k. Pay off your previous balance so you don’t get hit with interest and you’ll gain credit.

-

On time payments. At the very least, pay the minimum each month, but really one should be budgeting to pay it off each month to avoid interest.

-

Oldest account. I don’t like or use my first credit card, but I still have it. Note: cards must be used periodically to keep them active otherwise they won’t be considered, I want to say every 3 months. So even for my oldest card, I have a small subscription on it that hits monthly. This gives me an active, old credit line.

-

There are “good” forms of debt where on time payments is the name of the game. These are car loans, mortgages, etc. If you have the resources, set up auto pay on these so you never have to worry. Paying them off asap will save you on interest, but it could harm your credit as that is no longer an active line. It’s likely still in one’s benefit to pay them off, but then we get into a discussion of interest vs cost of money. That’s a different rabbit hole.

Uh, there’s other stuff, but my thumbs are tired. Hope this helps someone.

I have played around a bit credit score estimators on the credit agencies sites. If they are not lying, a few things found interesting.

The largest jumps in credit come from increasing the credit limit on existing credit cards. Opening a new card is a slight decrease in the score.

Mortgage and cars loans combined (installments) are how you get to “excellent credit”. When I was renting my credit was always 60 points lower. When I bought my first home my credit hit excellent for the first time 3 months later. When I paid off my cars my credit dropped by 20 points each time.

Late payments or missed payments on any account decrease the credit card the most.

Credit scores are designed to discourage you from taking out lots of loans in short amount of time. Buy a car, your score decreases for 3 months then bounces back up.

Just a note, but your credit score went up when you got a mortgage because it takes into account “mixed loan types” like unsecured credit (credit cards) where there is no collateral and secured loans (home/boay/auto) where there is.

When you have more mixed loans that you pay without issue, your score goes up.

It helped me recall all these facts!!

Thank you!

-

To play devil’s advocate, I wouldn’t trust a parachute that’s never been deployed or one that’s deployed every day for the last year. I want the parachute that was used maybe a dozen times over the last few months so that it’s not brand new but not overused so I know it works but isn’t a significant risk.

I have no idea how to calculate reliability, that’s just what monke brain thinks.

Yes, lenders lend to make money.

deleted by creator

I paid a credit card down from $1700 to $1200. My score went from 795 to 763. Fuck 'em and their fake money.

You’re still carrying a balance of $1200 though. Pay it off and it should go up.

Believe it or not, it is better for your credit score to carry a low balance on your credit accounts than no balance, because glue tastes yummy to the credit agencies, I assume. /s

The reality is that lenders would rather have customers that utilize their credit and pay a lot of interest than ones that aren’t lucrative and pay off their credit use immediately. They’re looking for people willing to fall into debt traps that are ALSO able to reliably pay the interest within them without ever defaulting. That is what a perfect customer/capital battery looks like to consumer lenders.

Which means that credit scores are just an arcane measure to determine the potential profitability of borrowers, NOT a metric of the most responsible borrowers at all, because that would mean utilizing the least credit.

it is better for your credit score to carry a low balance on your credit accounts than no balance

That’s a myth that credit providers like to persist because it tricks people into paying interest. Pay off your credit card every month, don’t carry a balance, and use less than 30% of your available credit. That’s what’s best for your credit score.

Please don’t spread that myth. You’re literally helping people fall for the trap you’re complaining about.

https://www.cnbc.com/select/what-is-a-good-credit-utilization-ratio/

"Why you shouldn’t go as low as a 0% credit utilization rate

If your CUR is 0%, it shows lenders and credit card issuers that you aren’t making any purchases on your credit card. Remember, it’s important to use your card.

“When a credit card account is reported with a zero balance, some scoring models will look at a zero balance as if the card is not being used,” Droske says. “Maybe it’s in your drawer at home, or, for whatever reason, you aren’t using it at that point. Not using it at all is not as good as using it in very small, controlled ways.”

While a 0% utilization is certainly better than having a high CUR, it’s not as good as something in the single digits. Depending on the scoring model used, some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score."

It’s not a myth. I keep a 0 debt load because I don’t want to be bothered playing their infantile game for another 20-30 points, but a low balance increases your score a little over a 0 balance.

I despise capitalism, and I know my enemy well. Credit utilization matters beyond full or no utilization. This is how credit scores work.

You can have debt utilization while still paying off the full statement balance each month and not being charged interest. I always have a balance, but I rarely carry the balance beyond the statement due date and interest free grace period. (I just have new charges that make the balance non zero.)

Your source does not seem very definitive.

“Depending on the scoring model used, some experts recommend aiming to keep your credit utilization rate at 10% (or below) as a healthy goal to get the best credit score.”

But even if carrying a single digit CUR is the optimal way to maximize your credit score, paying off your cards is going to be the best advice for 99% of people.

And even Experian, the credit reporting agency says carrying a balance helps your score is a myth.

paying off your cards is going to be the best advice for 99% of people

No duh, this isn’t asking for financial advice though. This post was about what maximizes your credit score.

Two entirely different things.

Also, you linked to an ad for what experian wants to sell you. The credit agencies have proven time and time again they are the last source of information you want to use regarding how they generate credit scores, when they aren’t proving they can’t be trusted with your data and should be dissolved by government for their constant data breaches it’s almost impossible to opt out from while still participating in society.

“Carrying a credit card balance will not benefit your credit score, but enrolling in Experian Boost®ø has helped many people increase FICO® Scores based on their Experian credit reports, and a free credit score from Experian can help you track progress toward score improvement.”

-Your source. A sales pitch is never a valid source, unless it’s to prove someone tried to sell you something.

You guys are talking about different things.

Credit utilization of 0% doesn’t mean paying your cards off on time every month so you avoid interest. It means paying your cards off before the statement period even closes so nothing is reported to the credit agencies.

I do this. All my cards have a statement period ending on the 19th or 20th. Around the 17th every month I pre-pay so my statement is $0 on every card.

When I use a card after doing this and the charge goes through before the statement closes, my FICO score goes up (vantage doesn’t seem to do this).

For the last 18 months or so my FICO has been going up 22 points every time there is at least a little balance to report and down 22 points every time my credit utilization is 0.0%.

You only need a balance on the day the company reports to the credit bureaus. They have to and will tell you the day they do this. You can buy something the day before and pay it off the dat after and never have a balance on your statement and still appear to be using credit.

Or, hear me out, he could go all Tyler Durden.

That’s probably not a good long term decision.

Your face is not a good long term decision.

That man had a family!

Also probably not the best decision.

Some institutions deserve to die.

It’s a good long term decision for the rest of us. I’d appreciate it if someone took that sacrifice sooner rather than later.

It won’t, necessarily. They don’t want people who will pay off their debt, they don’t make money off of interest if you pay your debt off. They want people constantly in debt making monthly payments.

Source: I paid off lots of debt and my score plummeted.

Your score could have gone down because closing the account effected the length of your credit history, or because the credit mix (types of accounts) was changed, or because the account showed the entire loan amount as available credit which was removed when the account was closed. Yes they make money off of people who carry some balance but they track credit scores to attempt to predict whether a person will repay credit that is offered to them.

deleted by creator

They like their little debt slaves

I’ll take a lower score and no debt. They can eat their score.

They said, getting an offer for as low as 20% on their mortgage.

I said, having locked in at 2.75 when rates were at a record low.

So the secret to not worrying about credit score is simply already have the loans you want at an interest rate you want. Why didn’t I try that???

Are we talking about 35 points from paying off a car? Or hundreds of points because reasons?

2 of the factors are debt to income ratio and how many accounts of different types are open. If you pay off 99% of a car and refinance 100$ loan for 84 months… does that keep your score up?

So the reason this kinda idiocy happens is when the line of credit is closed, it actually decreases the average age of your credit accounts- which decreases your score.

That’s why people who pay off student loans have their scores drop sometimes, especially if they’ve avoided any other lines of credit.

This. Average age of active credit accounts went down thus drop. Same thing happened to me

This is part of why getting credit cards early (if you’re capable of being responsible with them) is so important. All my oldest credit lines are credit cards (I have 4 of them), so any future loans will be taking my average credit line down instead of up. As a result I’ll always have those old credit lines and my score will only go up when I pay things off completely.

This right here is the way. Just gotta be cautious.

This is silly anyway. I’ve paid off and cancelled many credit cards and loans, and your score drops by a small amount temporarily. It doesn’t stay down.

“…we base our entire lives on”

The vast majority of people barely think about their credit score

I mean where you are allowed to live is impacted by credit score a lot.

As long as you’re in the middle you’re okayish. But how you live is impacted by it in the US.

Well yes, but also no. Buying a house or getting a mobile phone (a car too, but less so) are pretty essential parts of functioning in society.

Who the fuck needs credit to get a mobile phone? lmfao

That Android better be gold plated, able to use every network possible in the world with satellite without roaming, and shit out by Taylor Swift herself.

As a brit who moved to America with a company sponsored visa and half decent full time job I could only get a 250 dollar credit card and a pay as you go phone.

and a pay as you go phone.

Murica

If you’ve got a half decent job why do you need a credit card at all? And what’s wrong with PAYG? Phone contracts are for chumps!

I’d settle for an android that’s fully functional and programmed in multiple techniques.

It’s even being involved in job interviews and renting a house. I’m sure a bunch of others as well.

Sorry, we can’t just hire someone who’s in debt. Maybe come back in a few weeks when you’re in better shape financially.

Oh God, I forgot checking credit scores for applicants was legal

why do you need to take out a loan for a phone?

just go and buy one if you need it?My wife and I both have shit credit score, we still got a mortgage at a preferable rate based on our income and job stability alone.

Sorry to say, credit score is a meme

Yeah you only care about credit score when you’re young. I dont base shit off my credit score

Or when you’re american.

Credit rating measures your profitability to the credit industry, if you pay off your loan early, they make in interest, thus less profit.

Not entirely true. I’m what they call a deadbeat (meaning I pay off my cards in full every month and have been doing so for the past 10 years, making them $0 profit), and I have a 800 score.

I think the more correct way to think about it is that it’s an estimate of your profit potential. What everyone tells you to do with a score this high is to buy a house because you qualify for the best mortgage interest rates. But of course then they’ll have me on the hook for the next 30 years, and they stand to make in excess of $100k in profit.

100K profit on a mortgage? that’s insane

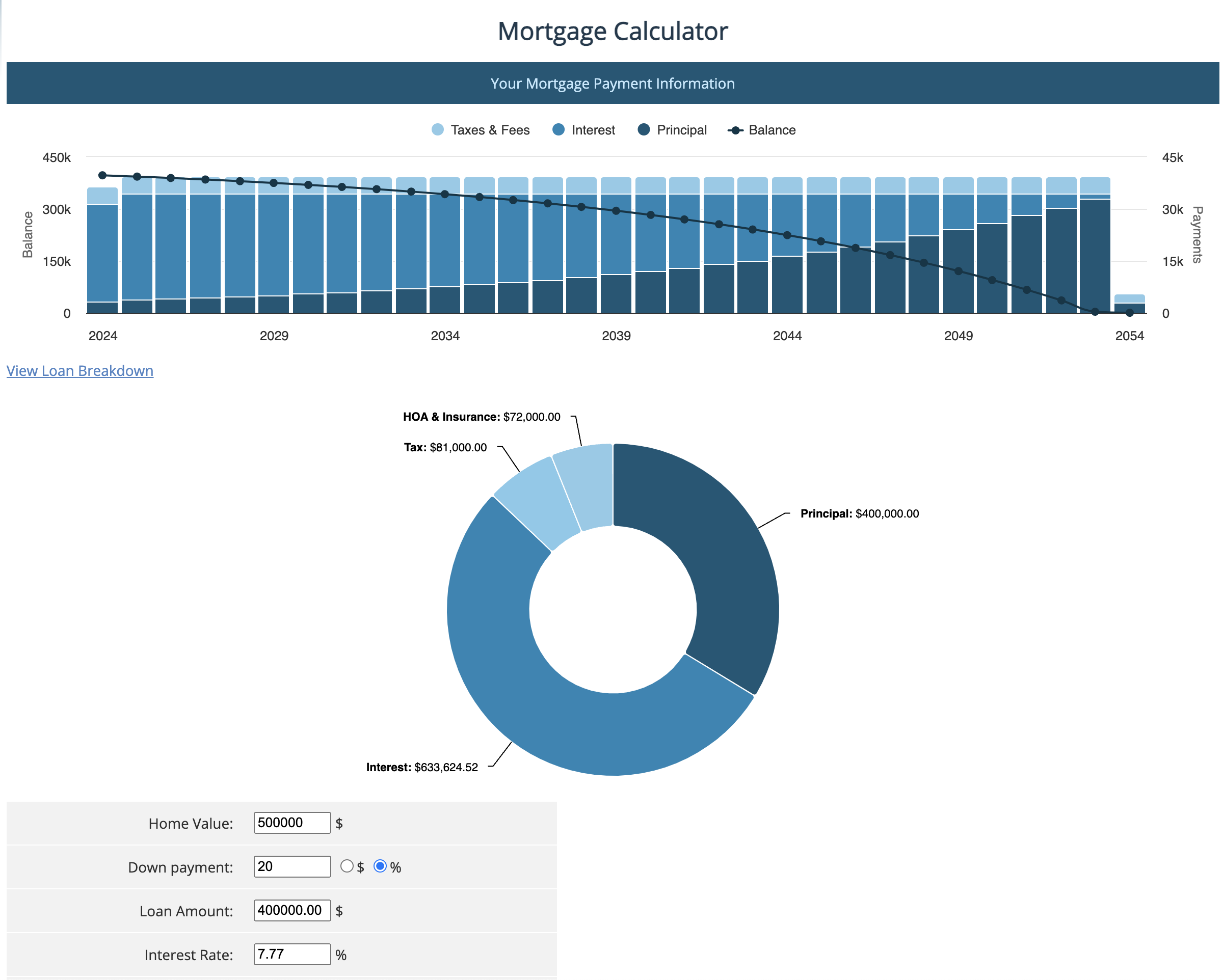

It’s actually far worse than that. If you get $400k loan at the current rate and pay it off over 30 years, you’ll end up paying over 1.5x times the principal in interest. Over the lifetime of the loan, a $500k home will cost you over $1M.

(from mortgagecalculator.org)

Wait why are the banks investing in home loans when instead investing that money into the stock market (should?) yield greater returns over the course of the loan period (even at a very conservative 5% yearly compounding interest, $400,000 turns into $1.7M over the course of 30 years)

Mortgages are fixed income. Stock market returns are variable and therefore riskier. One bad year can wipe out multiple years of gains. Meanwhile, the money you collect as interest has already been paid, and as you can see from the calculator, the interest is front loaded, meaning the majority of it is paid at the beginning of the loan. So even with the probability of a default wiping out the remainder that’s owed, it’s still a much safer investment.

Why aren’t these practices considered criminal?

Because the people and organizations with the capital to loan out millions of dollars for house purchases are the ones who make the rules.

What is your proposed alternative system? All of this is just an interest rate applied to an outstanding balance. Many less people would own a house without such an option.

Removed by mod

Mortgages are “secured debt”, meaning that they are backed by a collateral (in this case, the house). If the person defaults, the bank can seize the house. The risk is lower, and thus even when the interest rate is lower, the bank is willing to take it.

jeez, my apartment is fixed at 1% for 10 years, my house for some reason I didn’t think about fixing it for longer and it’s 1% for only 5 years, but even now that mortgages are peaking in my country they don’t go over 6%

Way more actually. Whatever the house costs you’ll pay 2x-3x in interest.

That would imply people who constantly carry credit card debt would have high credit ratings, which is false as far as I understand.

It’s not, really, although it’s a bit more nuanced than that.

Credit scores are now taking in more information than ever, so things like your debt repayments as a % of your income (affordability) are feeding in as well.

For the people carrying credit card debt, one CRA might give you a better score if you carry a balance >0 but <25% of your total credit limit, and another it could be 0 to 40% so you will see some score variability.

If your utilisation is higher your score may suffer. This is only one aspect, though. Repayments on other debt (mortgages, utilities, mobile phones) play a part, as do things like voter registration and the time you have kept open your accounts. TransUnion is now incorporating BNPL (like Klarna) data for some reporting, although not sure it feeds into the score view yet).

I would highly recommend using whatever free apps are available for each of the CRAs (TransUnion, Experian and Equifax are the three main providers) to monitor your score.

For TransUnion you should be able to use the Credit Karma app in both the US and UK, and in the UK you also have the ClearScore app for Equifax score.

Experian in the UK is on the process of removing 3rd party app access (would have been MoneySaving Expert app before, but that’s moving to TransUnion).

Voter registration?? So you get a higher score if you’re a certain political party. Alrighty then.

I wish they were transparent about what exactly they use and how they use it, not what they’re saying they “may” use.

Not sure which part of the world the above poster was referencing, but I wanted to highlight that in some countries (like the UK that is briefly mentioned) registering to vote doesn’t come with a political alignment, it’s merely registering to vote.

From what I recall that is definitely a factor in credit ratings here in the UK, and may well be in other countries as well.

No it’s nothing to do with political affiliation at all,

And someone has already replied about the UK which is largely where my experience lies in this area.

Voter registration (entry onto the electoral roll) is additional confirmation that the address you are using for other credit/loan information is accurate.

no it wouldn’t, due to the higher risk of them not peying it back

It is bullshit, but there are ways to game the system. Essentially, a higher credit score means you’re a better mark for creditors. It means you pay your bills, but you’re never debt free. In order to maximize your gains and keep the capitalist machine running, you always have to be leveraged in some meaningful way. Basically, if you’re really poor, you’re fucked, but if you can somehow manage your bills every month and put your normal expenses on a credit card of which you never use more than 50% of your limit, your score will go up. Finish paying off a car? Finance a new car! It’s ridiculous, but that’s what they want us to do to keep the ruling class in power.

You’re absolutely right.

Basically your credit score is some amalgam of how much credit you have available, vs how much you owe, and whether or not you pay your bills. If you have available credit and you have never used it, you suck. Giving you credit won’t get the lender anything for their trouble. If you have a little debt, and you consistently pay it (read, pay them interest), then your score goes up because you’re paying your creditors, so other creditors know that you’re a good source of income for them.

The only thing that having a good credit score does, is give banks and institutions information on how much they could possibly wring out of you.

My score should be through the roof, but I’m too leveraged, I have something like 80% usage of my available credit. But I have a nontrivial amount of debt that I have carried for years and I’ve (sometimes painfully) always paid my bills on time.

My suggestion for anyone currently carrying significant debt trying to pay it off and increase their credit score: pay more than your minimum and take every offer they give you. If some institution says you’re pre approved for some loan device, say yes. Even if you just throw it in a drawer. It will increase your total available credit driving down your occupied credit % and driving up your credit score.

Filling out every loan offer is insanity.

Normally it would be. For anyone in the position of barely treading water financially it’s a sound strategy.

The key is to claim the offer, but not use the financial resource. Just use it to boost your available credit and decrease your overall debt used.

If you claim it and immediately spend it, then you’re only going to hurt yourself.

I would agree that the system is insane.

If you’re trying to build your credit score, having a bunch of credit that you’re not using can help very much.

That, in and of itself is the key: having credit that you’re not using.

If you immediately use any credit you claim, then you’re going to eventually sink (go bankrupt), which takes 5 years, sometimes longer, to clear from your credit score.

The insanity of the system is evident. Understanding what the credit score really means, can inform your decisions about how to best maximize your score, if that’s your desire.

I know people who are classifiably wealthy with terrible credit scores because they’ve never needed credit for anything, so they don’t have any credit sources and certainly have not ever held a balance on a credit account for any length of time. So they look very bad on paper to creditors. Consequently I know very diligent people who are remarkably poor by comparison with near perfect scores because they know how to game the system in their favor, and do everything the way creditors want it to be done. They’re never so leveraged that it negatively impacts their score, they have plenty available and they’re never so much in debt that they can’t pay their interest.

It’s a stupid system.

I’m not saying the system isn’t stupid, I’m saying that blindly applying for every credit offer carries risk in and of itself. Plus hard credit pulls will temporarily hurt credit scores anyway. I just wanted to caveat that piece of advice for folks because I think being cautious and intentional with personal finance decisions makes more sense.

That’s not what I suggested. I’m speaking more on the lines of being pre-approved for credit, which usually doesn’t require a hard credit inquiry.

Usually your own bank will do stuff like this, or financial institutions that you have history with.

Credit increases and new forms of credit that are pre-approved are generally what people should focus on, not filling out applications for credit as much as possible.

Such offers are not frequent as long as they’re genuine, and usually result in a reduction in total credit utilization, which leads to a better credit score.

I also agree that filling out requests for credit without being promoted by your existing financial institutions can be detrimental, at least in the short term.

My credit isn’t perfect and I’m continually trying to improve by paying down my loans and credit accounts to try to get them to and keep them below 50%, but if my bank sends me an offer for a pre-approved card, I’ll go ahead and accept. When it arrives, I’ll activate it then toss it in a drawer and do everything in my power to never use it, simply to get that utilization number under 50% and keep it there.

It’s categorically ridiculous how the credit system in good ol’ 'Murica is based on you getting into debt so you can be deemed “trustworthy” by the banks.

A system designed to keep you tight om a leash, forever selling your labor to pay off that first debt.

Categorically ridiculous? Try systemic evil.

It’s even more “funny” if you think it’s the very opposite of how old fashioned bank managers used to judge people’s creditworthiness in order to decide if they should get a loan or not, back in the day (and not even that much back: algorithmic loan decisions only became a thing in the late 80s and 90s.).

There is a lot of misunderstanding about credit scores posted here.

The purpose of credit scores is to answer only one question:

How good are you at pay back a debt if someone were to loan you some money?

Thats it. Everything on how the score is calculated is weights and measures to service that question.

The reason that making payments on an active loan improves your score, is because it is real proof you are getting money from somewhere (the credit score doesn’t care where) and you’re choosing to spend that money on an agreed payment on the debt. Lets say I’m a lender and I’m considering giving you money, and I see that someone prior to me make a similar agreement, and you’re honoring that agreement to pay, then it gives me a good reason to think you’ll also pay on debts you have with me. The reason your score goes down when you pay off your last loan, is because I can’t see you still have the money to pay on a new loan. It means you’re a (slightly) higher risk because I’ll have to take it on faith that where ever you got the money to pay off the last one, you’ll also be able to get that money to pay off the one to me. There’s no guarantee for that, so its a risk to me, a lender.

Another thing I’m seeing missing in the discussion here is:

“Doing X makes your credit score go down”

Technically true, but many of those things that make it go down only do so for a short time. Maybe a month or two (using modern FICO score system).

There can be arguments as to which inputs they use, and how much each of those inputs affects the score. So much so, rating agencies themselves even change their minds over time. They update what they think is important and downgrade what they think matters less. You’ve likely heard of a FICO score. Over time there have been SIXTEEN DIFFERENT VERSIONS of what makes a FICO score source. Some of the variation you see when you get your score from different places is those places using slightly newer or older versions of the scoring system.

Unfortunately lots of organizations that have nothing to do with lending you money are choosing to use your credit score for their own systems. I’ve heard of insurance companies using FICO scores as inputs to how they calculate premiums, which they shouldn’t do. Some employers are using these now to filter applicants. Those employers are perverting the credit score system (again, a system just for loaning money) as a measure of trustworthiness or fidelity. I wouldn’t mind laws that prevent that as that isn’t what credit scores are designed for, and doesn’t answer that question.

How good are you at pay back a debt if someone were to loan you some money?

That’s the point!!!

The only information we are given is that the OP paid off a debt and the credit score went down. You claimed that maybe it is only temporary. But that still goes against your giant text claim.

Why does paying back a debt announce that you are bad at paying back a debt?

It doesn’t say that. You’re drawing your own conclusion from the score decrease. Also, I didn’t downvote you.

The only information we are given is that the OP paid off a debt and the credit score went down.

If that was the OPs only long term debt being serviced, (credit cards don’t count), the credit agency now has no proof you can CURRENTLY pay off a new debt. Meaning OP is a slightly higher risk.

Credit agency has no idea where the money came from that paid off the debt. It only knows that OP was regularly finding money somewhere, and that OP was putting that money toward debt as agreed. Did OP lose their job after paying off the debt and doesn’t have income anymore? Did OP have someone else helping them pay that that person won’t help in the future? The credit agency has no idea. It only knows that in the past they were able to service the debt, and today they have no way to measure if they can. So it is a slight increase in risk, meaning slight decrease in credit score.

All of that is technically true, but still kind of a shit policy as it consequently raises the cost of borrowing on someone who paid back the full loan plus interest.

You can rationalize all these shit policies with any number of talking points. Some of them might even be actuarially sound. But they’re still shit.

All of that is technically true, but still kind of a shit policy

Your complaint is with lenders then, not credit agencies. If someone misuses a tool, its not the fault of the toolmaker, but the person using the tool. Would you blame a hammer manufacturer because it is really crappy at driving in screws? I would hope not. You’d be upset at the person using the hammer to try to hammer in screws.

Your complaint is with lenders then, not credit agencies.

If the credit agency adjusts your score downward and then reports me out as “less credit worth” then my beef is the business that is effectively slandering me.

If someone misuses a tool, its not the fault of the toolmaker

If the tool reports inaccurate information, the toolmaker is at fault.

Who would you rather give a loan to? A person who you know is currently able to pay you back or a person you know was able to pay back the loan 10 years ago?

The person who just paid me back, because they can obviously pay me back.

Exactly, so that answers the question. When you finish paying your loan, you stop paying back money and thus your credit score is slightly lower than when you were actively paying back.

That’s the opposite of my point. Let me correct myself here. The person who just *finished paying me back because they can obviously *make every payment until it is paid back again, as they have obviously demonstrated.

The grade dropped as soon as the account was closed, not ten years later.

So this is

- Person who is currently carrying a loan

- Person who just successfully discharged a loan

And the answer would definitely be 2).

it consequently raises the cost of borrowing on someone who paid back the full loan plus interest

This is mostly likely untrue because she was paying off her debt the whole time she had the loan, and her credit score and history were probably improving that whole time. Maybe her score went up 300 points over the years of that loan, and then dropped 35 points.

her credit score and history were probably improving that whole time

Until she paid it off, at which point it dropped.

Maybe her score went up 300 points over the years of that loan

Maybe, but I highly doubt it. And 35 points is a big drop when you’re already in the 700-range. That can be worth a quarter point on a mortgage loan, which will end up costing you tens of thousands of dollars over the life of the note.

And 35 points is a big drop when you’re already in the 700-range.

Which means the tons of points she likely gained by paying off the debt for years saved her at least a point.

I’m not arguing that a lower credit score isn’t worse, I’m pointing out that cherry picking a single month movement to claim that she got screwed for doing something that actually likely helped her doesn’t make any sense.

Which means the tons of points she likely gained

No. Because there’s a soft ceiling. If she started in the 700s, she wasn’t going to get a 1000 credit score by the end of the loan. Those don’t exist. She wasn’t going to hit 850 for carrying a single small commercial loan, either.

cherry picking a single month movement

This isn’t cherry picking, its about incentives.

If I’m carrying a car note and I don’t want to be saddled with debt, I’m forced to take a credit hit because I’m finished paying my loan. This impacts the cost of a future loan when my car needs to be replaced.

By contrast, if I’m loose with my money, I’m effectively rewarded for refinancing or rotating out my vehicle before my loan expires and remaining in debt indefinitely.

The credit score becomes a means of penalizing people for failing to carry these burdensome loans uninterrupted.

No it isn’t. It’s to force you to use credit under the guise of checking how good you would be at paying back.

I’m from europe, you know how much credit i had before i got a loan for my condo? absolutely zero. All they needed to know was that i had no debts, lived well within my means, knew what i was doing, not “how many credit cards and car loans have you got running”. The best possible person to loan money to is someone with 0 credit history who can prove they’ve got a solid source of income, and are living well within their means. Because you know, once i bought my condo, paying my loan is the exact same thing as paying my rent.

And if you wonder if i got a decent loan with such a “terrible credit history”. It was a loan with variable interest rate, after the first change, my interest dropped to 0 due to the financial crisis, and it remained at 0 until i paid it of.

Anyone actually believing the american credit score system is anything else than just a way to force you to use credit while you really shouldn’t, is just indoctrinated. I’m sorry, but someone perfectly paying rent, and saving up for purchasing a house without ever using any credit is the perfect person to give a good mortgage too, and the exact kind of person this system sets out to punish because they’re not taking part in the American banking system the way the banks want you to.

The best possible person to loan money to is someone with 0 credit history who can prove they’ve got a solid source of income, and are living well within their means.

Okay, so the “solid income” component is easily provable.

How can a lender know you’re living well within your means?

I’m sorry, but someone perfectly paying rent, and saving up for purchasing a house without ever using any credit is the perfect person to give a good mortgage too

Paying rent is NOT equivalent to paying a mortgage. With rent, you’re responsible for only making the rent payment. Nothing for housing upkeep and repair. Almost zero liability on how you keep your home could make you open to a law suit. No renter has to pay for the replacement of a roof or complete replacement of HVAC. Skills developed only to pay rent are insufficient for home ownership. That doesn’t mean a renter can’t grow to those home ownership skills too, but it isn’t equivalent as you’re suggesting…

Someone else already replied, but about living within your means, lenders can look up other debts you have, and missed payments you have. And they all request access to your pay slips so they get a basic view of your income. In the end it’s close to the credit score system, with the difference that someone who doesn’t have any loans or credit cards willl also have a good score since they don’t have any missing payments, and haven’t gathered too much debt already, which makes sense.

Regarding your point of rent vs ownership. In the end you can still boil it down to needing a certain amount of money/month. Only part of it is your mortgage of course, you need to save up for bigger things, but it’s not that different. And i don’t even see this being relevant in this discussion, i don’t see how the credit score system would predict you being up to being a house owner and setting money aside for bigger repairs.

How can a lender know you’re living well within your means?

It basically goes like this: here (the Netherlands) debt is registered, including what your monthly payments on those debts are. When you want to get a new loan you go to the bank with proof of income, they then look at your existing debt / payments and make an estimation of your cost of living. You will only be approved for a loan if monthly payments for current and the new loan + cost of living < your income.

You’re not supposed to be able to borrow more than you can afford the payments on.

Of course you can still get into trouble if you have a sudden drop in income, but at that point you can’t get any additional loans.

They also register non-payment of debts, not just on loans but also on things like energy bills, rent, cell phone plans, etc.

The best situation is that they have no records on you, because that means that you have no outstanding debt and no failures to pay.

The first part of what you say is still off even. Its based on other factors like debt to income, income amount and credit utilization. different lenders also use different calculations depending on the type of loan. For example a mortgage wont be the same as an auto loan and theres even a system for renters the scores can vary wildly and really the numbers dont even mean fuck all half the time. Underwriting is a whole career and a company doing lending that knows anything will look at how well you actually pay your obligations and weight it with how much you make, practically ignoring the score itself. Ive seen people with 350s get top tier financing and people with 700s without even a thin file (low history) get completely denied or stupid interest rates.

For reference I havent missed a single payment in my entire life, my credit is damn straight outside of some credit utilization on low limit cards and because of that my score is “mid” i dont really care at all though cause chasing the number will stress you out and you wont benefit much from it if you just make your payments anyways. Ive still gotten approved for most things ive applied for because of making my payments

Its based on other factors like debt to income, income amount and credit utilization.

You’re off on some of your measurements. FICO scores are based on only 5 inputs:

- payment history (35%)

- amounts owed (30%)

- length of credit history (15%)

- new credit (10%)

- credit mix (10%).

different lenders also use different calculations depending on the type of loan.

I already touched on that with the 16 different types of credit scores: source

Underwriting is a whole career and a company doing lending that knows anything will look at how well you actually pay your obligations and weight it with how much you make, practically ignoring the score itself.

You’re right that underwriting is a whole career, but we’re not talking about underwriting. We’re talking about FICO credit scores. You’re bringing in things that aren’t credit score, but are factors that lenders use for determining loan worthiness and interest they charge, but that isn’t FICO credit scores.

Myself and OP are talking about the price of apples here. You’re asking me why an apple pie costs so much. Yes, apples are an ingredient in apple pies but not the only thing that influence the cost of the pie.

You are correct, I misinterpreted a bit. Sorry for confusion

Honestly, after 700, it doesn’t matter if you’re 765 or 800. You’re already approved.

Bunch of rentals in Seattle are requiring credit of 750+. I thought my 740 credit wasn’t half bad for only being in the credit game for like 6 months but it still can’t get me shit here

A minimum 750 credit score is crazy. I haven’t ever missed a payment on any line of credit in my life and mine is 751. The maximum is 850 for god’s sake!

At a certain point it’s just excluding younger applicants, because their credit history is just too short to hit that requirement regardless of the other factors. Now if you want an easy way around it, just buy a trade line - pay someone to add your name to their credit card, and your credit score (temporarily) goes up. Bullshit for a bullshit system.

Errrr, I was low 700 and was approved for the lowest rate in Bellevue. Maybe you should try a different bank.

I just had to check… I’ve been paying bills and shit on time for 15+ years and I am barely at 748. I even have like 60k USD in available credit. How the fuck do they have a minimum of 750 like wtf.

On another note, something also crazy is that I noticed that when I bought my first home my credit dropped 100 points. The banks actually lowered my credit score on buying a house…

Age of accounts and utilization are huge factors, so if you’ve opened and closed a lot of accounts, and if you’re over 10% utilization then your score will come down. Leave accounts open even if you don’t use them. The age will help.

740 is great, don’t let those fuckers get you down.

To get a car financed I think above 715 is the best place to be.

The easiest way to get an 800+ credit score is with a mortgage. If you have marginal credit taking the crappy mortgage will make your score better and you can refinance in 12-18 months and get a better deal.

My uhm, social score… cough, I mean credit score is very good right now. I’ve been a good little capitalist.

*score goes down 17 points for coughing*

insurance goes up $50 due to preexisting condition

LEMME OFF THIS FUCKING RIDE ALREADY!!!

ITT I’m seeing a few common misconceptions repeated by many otherwise correct and knowledgeable commenters without remediation. I’m addressing them here, because understanding financial systems empowers everyone, whether they wish to use them, change them, or burn them to the ground.

- Lenders only see your credit score. Mixed truth. Lenders can order specific scores to get a quick idea of credit-worthiness, but for most credit decisions a credit report or ordered. (This is often called a hard inquiry, and indicates a credit was applied for. A single inquiry is basically ignored by most scoring models. Many inquiries in a short timespan can be considered risky.) Regardless, the report is the same one you see when you order it directly from a credit bureau.

- Your credit score is universal. Mostly false. Credit scores are just someone’s guess of your risk to a lender based on data reported by previous lenders. Good guessers can make money guessing, but none are perfect, and some are only good at guessing risk for specific contexts. Who are they? First, there are the bureaus. They have various branded scores that they sell as products to lenders (for credit decisions) and borrowers (for credit building). Next, there are numerous companies who exclusively develop and sell scoring models. Finally, some lenders such as larger banks develop their own internal scoring models. All the above are adjusted regularly and tailored for specific industries and debt classes. I say “mostly false,” because it’s true that many scores use similar scales and the same records, which means they tend to rise and fall together. That’s why lot of people, even financial wellness advocates, often talk about “your score” as if it’s a single agreed-upon value, but the reality is scores are numerous, distinct, and variable.

- Credit reporting agencies use personal information for scoring. Mixed truth. Many bureaus have affiliated entities that broker financial data for ad revenue, but the information they are allowed to distribute in credit reports is tightly regulated in most countries. (Exceptions: there are alternative scoring model providers who fill a gap of niche debt types sought by applicants with no credit history, such as LexisNexis’ “RiskView” which can use more personal details like address stability and online purchase history to determine risk.)

- Credit history is permanent. False. Negative records like late payment, non-payment, and bankruptcies have expiration dates by law in most countries. Aside from when accounts were opened and closed, generally nothing in a credit report is permanent, and the scores can be extremely variable in practice.

- I should worry about my old credit score. False. Credit scores are used and discarded. New score overwrites old. The only thing that persists would be a credit decision, if there is one. Most scores are partially based on transient data and thus can bounce around wildly. For example, VantageScore 2.0 can dip by over 150 points because a large transaction put a card slightly over the limit but then rebound 150 points after the balance is reported within the limit. Similarly, FICO 8 can jump by 100 points just because the applicant was added as an authorized user to a card with a long payment history. Likewise, most scores can rise and fall drastically based on credit utilization (which is usually reported based previous statement balance, meaning even if you pay off cards every month your credit score will fluctuate in proportion to variance in monthly spending).

- Banks like credit card debt. False True. (Corrected by @d00ery@lemmy.world) Banks love it when you carry a balance. The interest accounts for the majority of their revenue.

The volatility of scoring is the most important takeaway, I think. The temporary nature of scores can be exploited pretty easily. If you understand how they work, you can often get the score you need at a particular time with a bit of planning. And the rest of the time, when you aren’t using your scores for anything, they’re vanity numbers at best.

Anyway, if I missed something or am wrong, please point it out.

I was under the impression that many hard inquiries in a small time frame was ignored because it means you’re shopping for a loan.

Having a single hard enquiry every so often would mean you’re needing to keep borrowing money for some reason.

True. This inquiry collapsing behavior is a feature of recent iterations of two popular models: FICO (8,9,10) and VantageScore (2.0,3.0).

Note however that:

- It only works for certain types of debt. For example, FICO8+ includes auto, student, and mortgage. VantageScore2+ includes utilities, auto, mortgage. No model includes revolving accounts like credit, retail, or charge cards.

- The inquiry collapsing behavior only occurs within a single asset class. For example, FICO8+ would collapse simultaneous shopping for student loans, car loans, and mortgages into 3 inquiries, not 1.

- The shopping period varies. FICO8+ ignores same-class inquiries for 30 days and collapses same-class inquiries within a 45-day window. VantageScore2+ does the same but only within a 14-day window.

Bonus hack: Certain banks also routinely collapse/reuse inquiries for same-day applications, permitting additional applications “for free,” which can be useful if you are denied your first choice and have a fallback in mind or if you are instantly approved for one product and want to try for another.

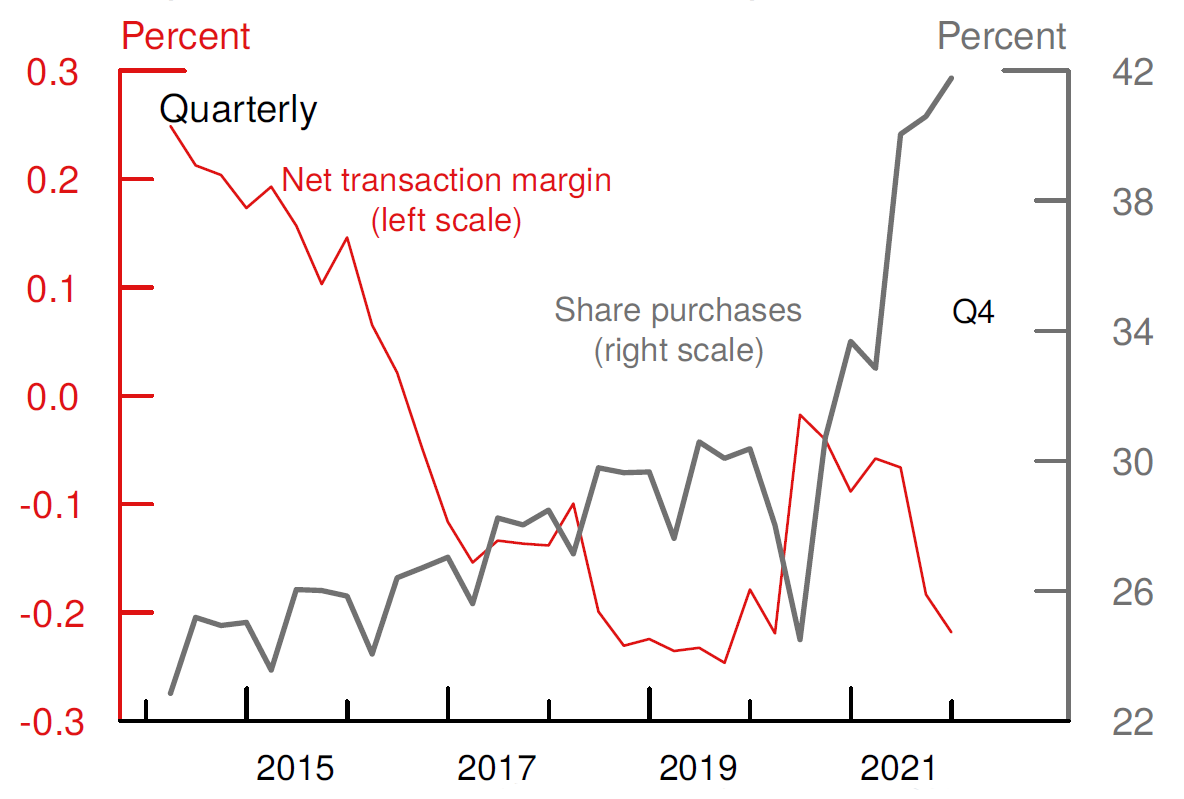

Credit card companies posted $176 billion in income in 2020, down from $178 billion in 2018. Interest fees accounted for $76 billion and interchange [merchant] fees accounted for $51 billion in 2020.

https://www.fool.com/the-ascent/research/credit-card-company-earnings/

This source suggests interest, fees and charges account for well over 50% of income

True! Fed data corroborates this, and it appears the gap has only widened since.

(Image from 2022 CC profitability report)

So I was wrong. Thank you for the heads up. I’ll correct it shortly.

Interesting to see that this has only changed, fairly (last 3 - 6 years), recently and the profit from merchant vs interest fees has pretty much flipped!

I didn’t know about the Fed data, so that to me feels like a good solid source as well.

Credit history length was shortened, lowering the score. Just give it another 5-7 years it’ll build back up!

I shat my credit into single digit range threeish decades ago (yeah, I’m a boomer puke). I couldn’t even get a bank account until about eight years ago. I finally was able to get an acct, got a secured card, and built my credit up to 729. ‘Upgraded’ my secured card to unsecured, but left the limit at $300 to keep me in check.

Then I made the mistake for applying for a modest credit line with my bank. Not only did I get denied, but the hard credit hit put me under 700. Then my credit took another major hit because I used that card for more than 31% of its limit. Never once made a late payment, neither.

As I hoped that a line of credit could afford me access to an oral surgeon (which I really need to even consider dentures, as I have mucho malo in my mouth), and as I have no interest in writing a grant to cover it, I’m fucked, as oral surgeons don’t seem to take Medicaid in my shit state.

If I survive another yearish, Medicare might be helpful, but the problems in my pie-hole might not wait that long.

I do not want a handout. I want the chance to pay it off and not leave it to Medicare…and not die of the infections spreading to either my brain (such as it is) or my heart.

(Yaay, America!)

Why do you use credit cards in the first place? As a non American I never really understood that. Why doesn’t America just have the “normal” (from my perspective) bank cards that just let you use money from your bank account. Why do you need to borrow and pay back? It seems like such a weird system, not just weird also dangerous, where you can end up in debt.

Agreed. Weird system, and dangerous for many. That’s why I only allow myself a very limited card, which is what I used to build my shitty credit back up.

American here. We have normal cards, they are called debit cards and are what most people use. Generizing a lot here, but credit cards are for people who were never financially educated, desperate poor people, or people who only use them to get plane miles or cash back.

It’s absurd to me to put myself in debt for all but the most desperate of cases.

Thanks, I didn’t know that, you always hear about credit card (debt) but never about debit cards. Can you still use the for a good credit score?

I don’t think debit cards or their associated bank accounts affect your credit in any way since those transactions don’t go through any of the credit agencies.

When I was just starting out in life, I had a credit card but only used it maybe once a year. Just with that I somehow had a credit score in the upper 700s.

Credit cards offer more fraud protection, at least where I live, while debit cards offer nothing much. I buy on credit and pay it off fully every month.

Most Americans can’t afford a $400 emergency and live pay check to paycheck. Car breaks down, emergency medical expenses, emergency house breaks down could all cost over $400. You need a Credit card for that back up that you could eventually pay back by probably sacrificing something else. Need a car need a credit score or you pay $3-10,000 more in interest same with buying a home. Want to rent need a credit check. Want to get a job at a bank, military contractor, some government positions, and other secure jobs. They want to make sure you don’t have bad credit or can’t be taken advantage of . Which no credit is often considered bad credit.

If you don’t have 400 in savings and live paycheck to paycheck how can you borrow 400? Like how can you pay that back? It still seems really weird, and if you can somehow pay it back, why didn’t you save a small amount before the car broke down?

Buy ramen, skip meals, Put off getting new shoes for another year, Don’t get a haircut, skip an oil change, run your car on a donut, cut cable or internet or phone for a few months, pick up overtime or get a second job, wait for tax refund.

There is flexibility but doesn’t mean you have savings. When you are poor some things are an emergency and sometimes you have flexibility or a chance to earn a bit more money. But when you are poor life is expensive and there is a ton of things you can buy as an upgrade, fix, or comfort.

When you are poor there is an endless list of things that need to be fixed and improved.

Median income for an individual is $50k median which is $39,129 a year after taxes. $3,260 monthly budget. Rent for 1 bedroom is $1,496 that is 46% of your real income. Usda say cost for food for male is 300$ a month on the low side that brings you to $1,464. Transportation for a household with 1 car(not median individual) is 410$ a month. $1054-electric $84- phone $140-water $30- health insurance $456 - car insurance $165- internet $75 =$104 leftover

Some of these costs are a mix of average per person or median per person. Health insurance cost you money to use. I didn’t put dental or eye insurance it is easy for you to live in a place where these expenses are more or less. Only recently has 10% of Americans built positive wealth. I think we got it to 7% recently people aren’t in total debt. (1% of Americans is 3.5 million people)

Most good credit cards have some form cash back, as in they give you a little bit of the credit card processing fee they place on merchants. Credit card benefits vary from card to card.

We use credit cards so much because it builds our credit score, which makes it significantly easier to take out loans for large purchases (eg car, house, etc) or rent an apartment.

We do have “normal” cards, they’re called debit cards. You are right that it’s weird and bizarre and dangerous. You shouldn’t be using credit cards if you’re living paycheck to paycheck imo.

Does that mean that your credit score is determined by companies? Or is the credit score something the government calculates for people?

I think in the Netherlands if you want to get a mortgage, the bank looks at your income, other loans you have, etc and they determine on rules the government set how much you ca borrow. There is a register for people that fail to pay bills, but it’s not something you get on easily, you really need to fail a lot.

Have you considered committing a crime and getting caught so that you can go to prison for a year or two and get free dental?

As much as I can see the appeal of gaming the system, I don’t look good in orange.

Also, I have gigs to attend to (filthy bass player here), as well as taking care of my sweetheart, who has wicked mobility issues. I don’t think I can do that from a cell.

I like the cut of your jib, tho’.

Best of luck then, friend 🙏

Even though we Australians get mostly free healthcare, teeth are still considered luxury bones that we have to pay for out of pocket too.

Imagine a country for which this sounds even remotely viable.

It seems there are details missing from your story. I find some similarities to your story to my credit history and I’ve had drastically different results.

Also, single digit credit scores aren’t a thing.

What’s a “boomer puke”?

Not really any significant details missing.

The single digit score was what I was told by a friend in banking who looked it up for me, years ago, but I’m not arguing with you, as I didn’t see it with my own eyes. She could have been lying.

Boomer = old person. Puke = asshole, fucker, or other insult.